Antwort What’s the worst a debt collector can do? Weitere Antworten – What is the most a debt collector can do

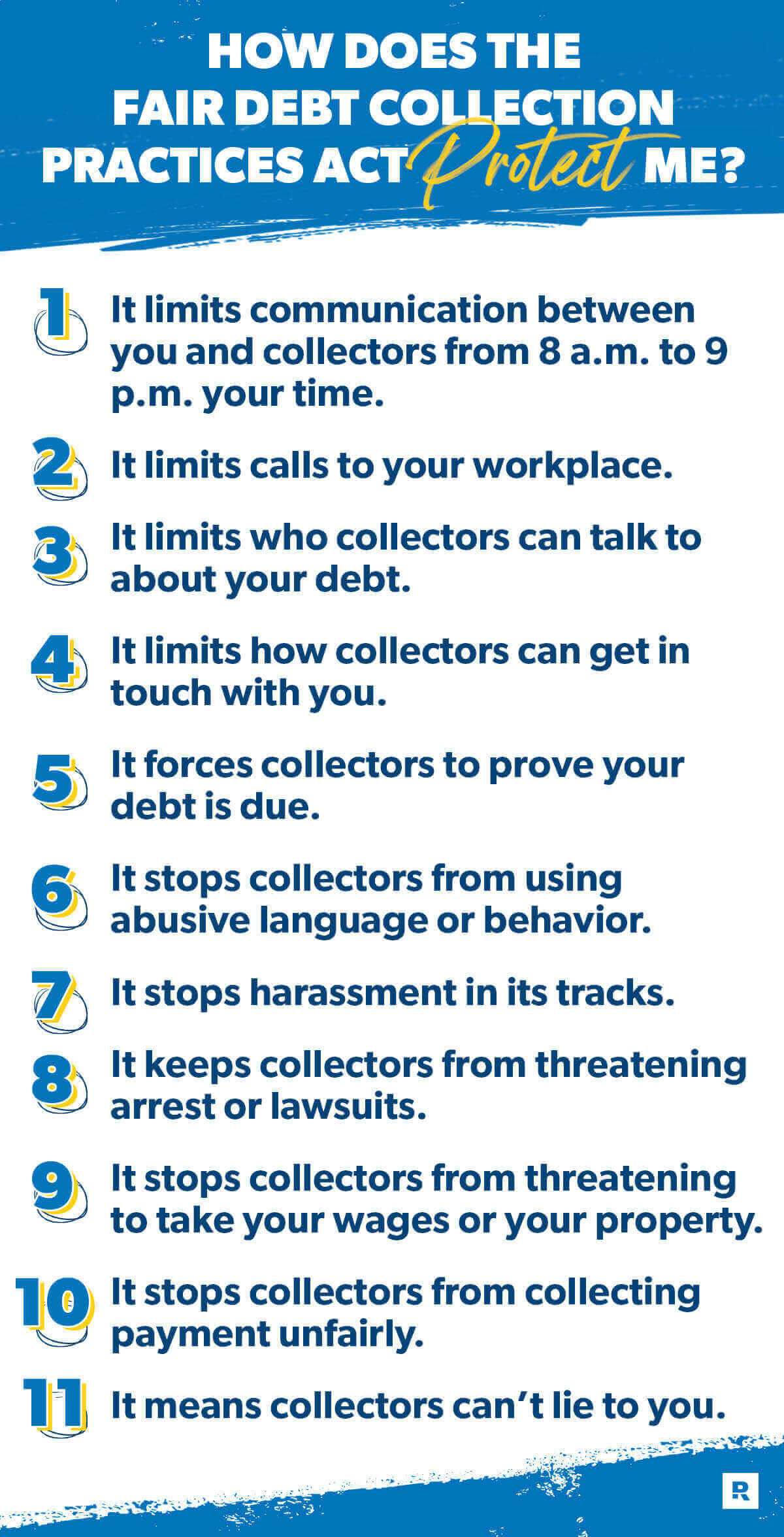

A debt collector can contact your spouse. A debt collector can contact your parents or guardian if you are under 18 years old or live with them. A debt collector can also contact your attorney and, if otherwise allowed by law, credit reporting companies (Equifax, Experian, and TransUnion) about your debt.Under the FDCPA, third-party debt collectors cannot use profane or obscene language. They cannot threaten you with violence or other criminal acts.You can outsmart debt collectors by following these tips:

- Keep a record of all communication with debt collectors.

- Send a Debt Validation Letter and force them to verify your debt.

- Write a cease and desist letter.

- Explain the debt is not legitimate.

- Review your credit reports.

- Explain that you cannot afford to pay.

What is a weakness as a debt collector : Lack of current information on debtors. Difficulty identifying and contacting debtors. Difficulty in accessing the most valuable information. Takes too long to locate debtors when sorting through all the data.

What happens after 7 years of not paying debt

The 7-year rule means that each negative remark remains on your report for 7 years (possibly more depending on the remark). However, after that period has ended, a remark will most probably fall off of your report.

What happens if you never pay collections : If you don't pay, the collection agency can sue you to try to collect the debt. If successful, the court may grant them the authority to garnish your wages or bank account or place a lien on your property. You can defend yourself in a debt collection lawsuit or file bankruptcy to stop collection actions.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Debt collectors do not have any special powers to collect a debt. They can contact you by: Phone calls. Letters.

Why debt collectors are bad

Debt collectors often have a reputation for being obnoxious, rude, and even scary while trying to get borrowers to pay up. The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb annoying and abusive behaviors. Even so, some debt collectors flout the law.Banks and other lenders typically turn over delinquent accounts to collection agencies after 4-6 months without payment. The original creditor should inform you that your account is being sent to collections. If that happens, consider it a wakeup call.Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

If the debt is not collected, then the debt collector does not make money. In many cases, although you would think that debt collectors would eventually give up, they are known to be relentless. Debt collectors will push you until they get paid, and use sneaky tactics as well.

How long does it take for debt collectors to give up : Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt. State where you live.

What is the credit secret loophole : They have to remove. It that's good if there's a legitimate error. But youtubers. And credit repair companies promise to use it and wipe off actual debt accounts you owe.

What happens if I never pay the debt collector

If you don't pay, the collection agency can sue you to try to collect the debt. If successful, the court may grant them the authority to garnish your wages or bank account or place a lien on your property. You can defend yourself in a debt collection lawsuit or file bankruptcy to stop collection actions.

Beyond contacting you directly, they can take you to court and sue for what you owe them. If they win—or you don't show up in court—they may be able to take money from your bank account, garnish your wages or place a lien on your property. After a certain period, debt collectors lose the right to sue you in court.They can keep trying to collect your debt until the sun explodes. But once the statute of limitations has expired, you're not legally obligated to make a payment. This is most important to keep in mind in the event that the creditor tries to sue you for the debt.

Should I pay off a 5 year old collection : Paying off collections could increase scores from the latest credit scoring models, but if your lender uses an older version, your score might not change. Regardless of whether it will raise your score quickly, paying off collection accounts is usually a good idea.